Read the latest news from our team

Delve into our team's latest updates, insights, and deep dives, showcasing the evolution and impact of our lending solution.

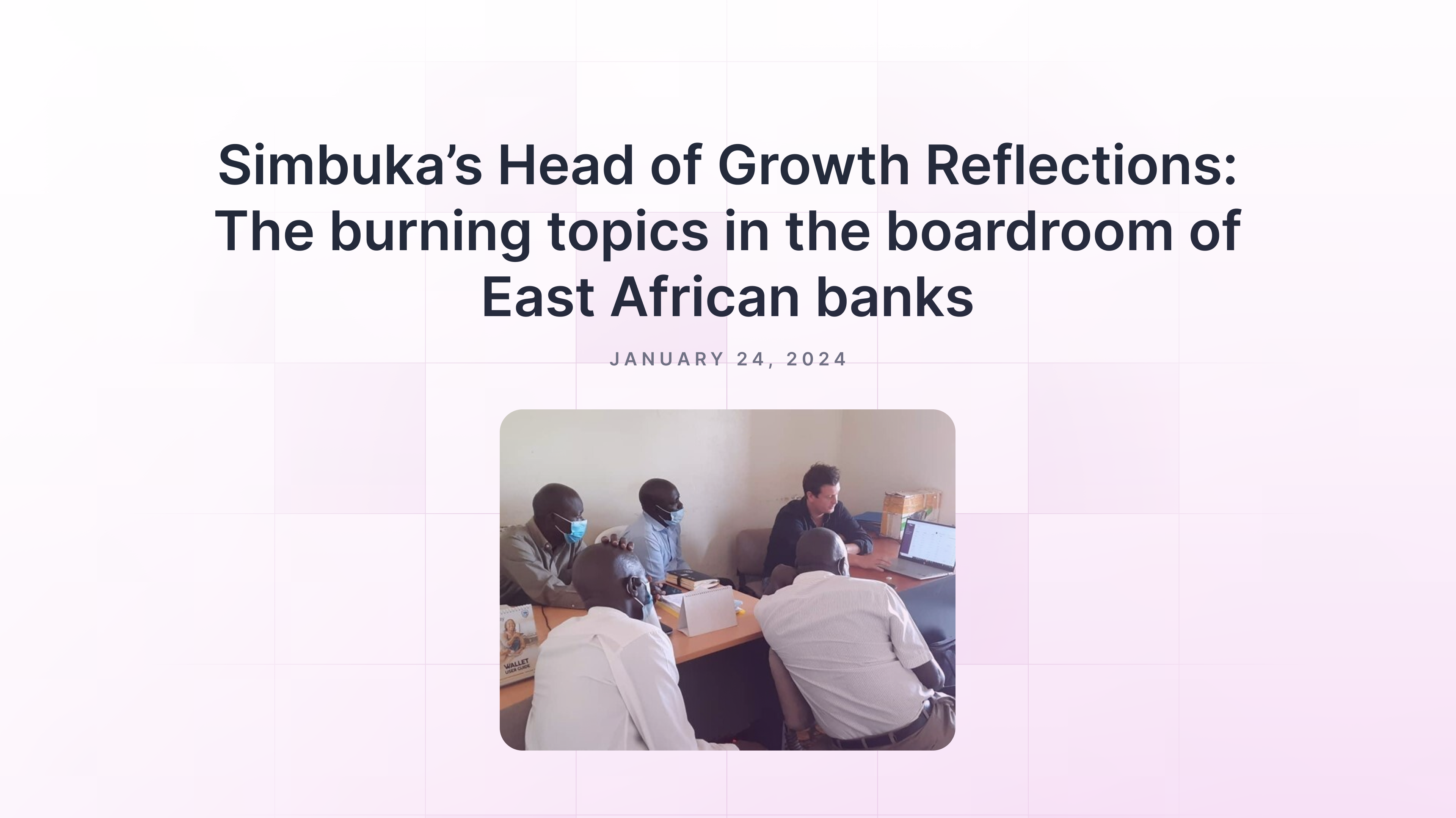

Simbuka’s Head of Growth Reflections: The burning topics in the boardroom of East African banks

Join engaging discussions with bank executives on key industry challenges and growth strategies. Explore credit scoring model optimization, the in-house vs. SaaS debate, and the impact of straight-through loan processing. Gain insights into the evolving East African banking landscape, from digital transformation to process efficiency.

One Year In: Measuring the Success of the From Micro Giving to Micro Credit project

In our previous blog, From Micro Giving to Micro Credit: Simbuka’s Role in Creating 1000+ Jobs in Uganda, we introduced a transformative project launched in August 2022. A year in, it’s time to reflect on our progress. While the project officially began last August, participants have completed only 28 weeks, just a quarter of the full program, as the initial months focused on laying the groundwork for real impact.

From Micro Giving to Micro Credit: Simbuka's Role in Creating 1100+ Jobs in Uganda

The From Micro Giving to Micro Credit project, backed by the Challenge Fund for Youth Employment and led by Simbuka alongside 100WEEKS, Rabo Foundation, and AMFIU, is empowering 600 young women. Through cash support, training, savings groups, and micro-credit, it fosters entrepreneurship. Simbuka enables inclusive banking, ensuring rural access to loans—driving lasting impact beyond job creation.

Empowering Tanzanian Banks: Simbuka's system integration with the Government

Simbuka's integration with the Tanzanian government is transforming loan access for over 700,000 government employees. By digitizing the process, it boosts efficiency, cuts costs, and enhances risk assessment. This shift replaces manual workflows, promoting responsible lending and financial inclusion—advancing Tanzania’s lending landscape toward a modern, accessible future.

Unlocking the Power of Scorecards: A New Era in Credit Scoring

In today's dynamic banking and finance industry, keeping up isn't optional—it's essential. A key tool for financial institutions is the scorecard, but what makes it so crucial in credit scoring? This blog explores scorecards, why traditional methods fall short, and how an innovative solution can transform your credit scoring process.

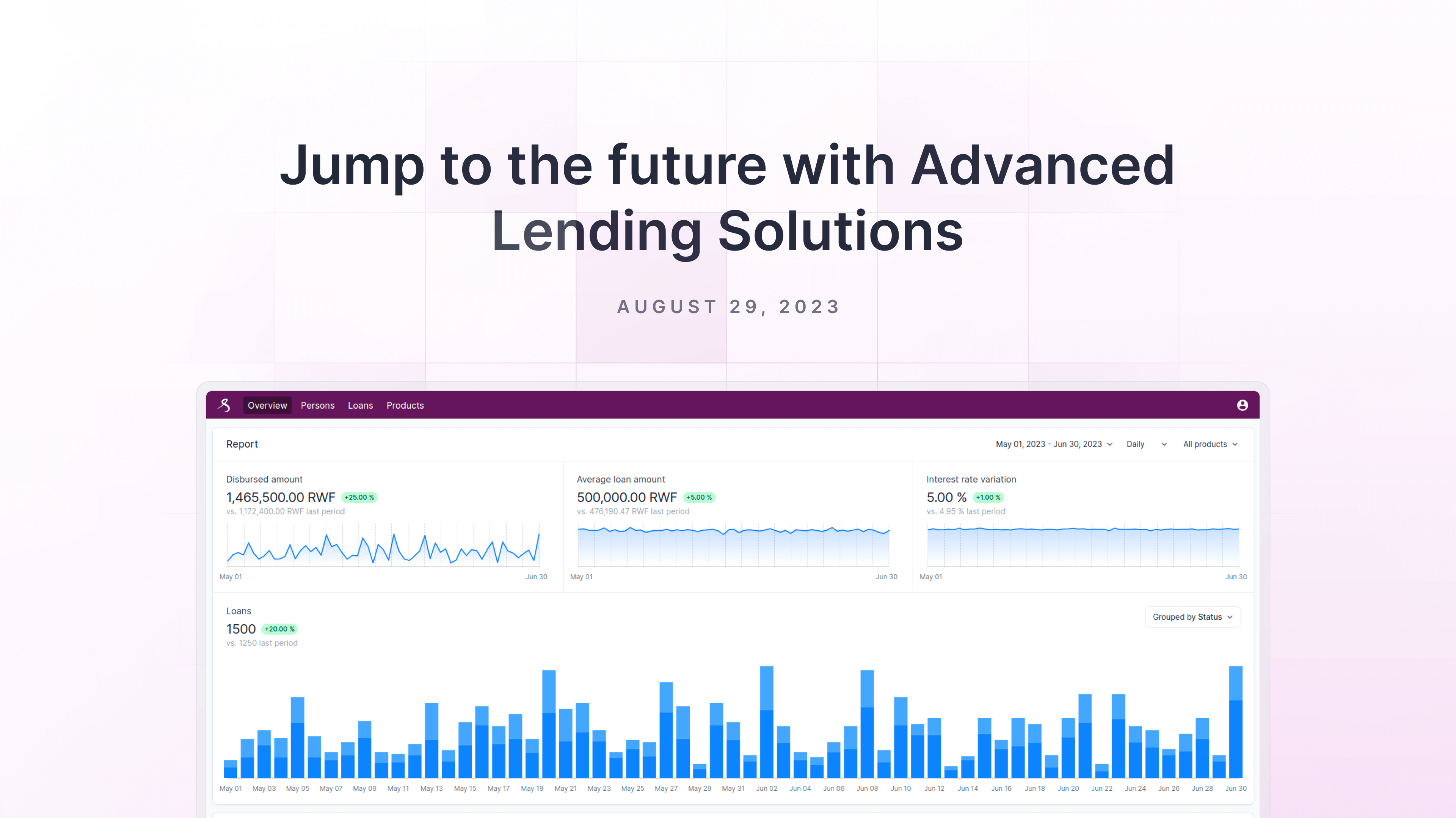

Jump to the future with Advanced Lending Solutions

Shaping the future of lending, Simbuka began in the Netherlands in 2011 and now operates in 37 countries across five continents. Our name, meaning 'leaping forward' in Kinyarwanda, reflects our mission. With transparency, dedication, and authenticity at our core, we empower financial institutions through customizable solutions. Discover how we’re redefining lending.