Empowering Tanzanian Banks: Simbuka's system integration with the Government

In a groundbreaking initiative, Simbuka has integrated with the government of Tanzania to embark on a transformative project to bolster the country's banking sector.

What is in there for the banks?

- Banking for more than 700,000 Government Employees: with more than 700,000 government employees at its helm, this project is set to unlock opportunities and redefine the future of banking in Tanzania.

- Access to the Salary Worker Loan (SWL): with this project, Tanzanian banks will gain unprecedented access to the coveted Salary Worker Loan (SWL) market.

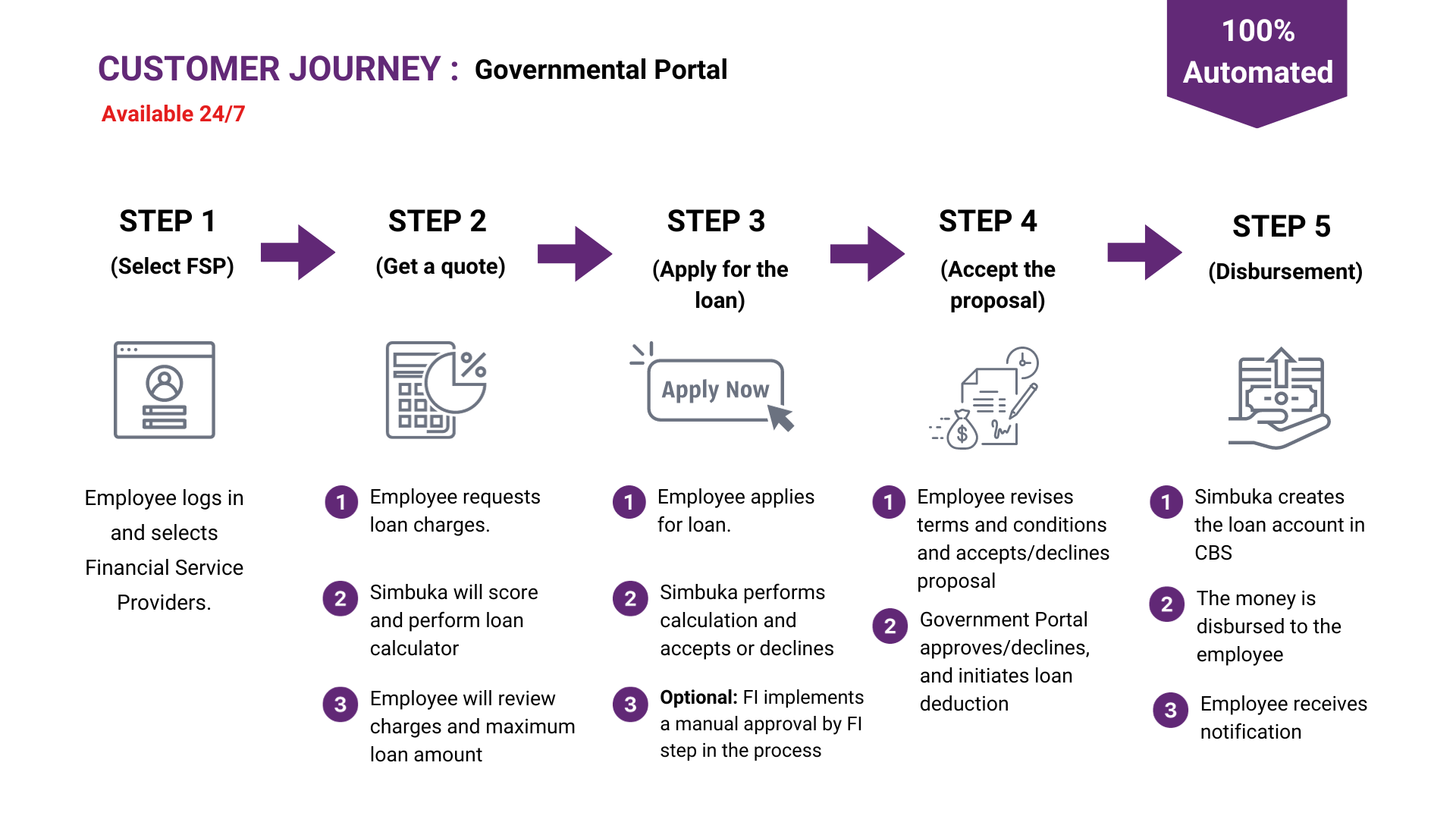

- Digitizing the Loan Origination Process: no longer will banks be bogged down by cumbersome paperwork and antiquated processes. Digitalizing the loan origination process is on the horizon, promising to streamline operations and reduce costs.

- Get more customers and Cross-Selling opportunities: Banks will have the opportunity to expand their market share in this highly profitable sector while leveraging cross-selling strategies to offer various financial products and services to government employees.

- Real-Time Insights with Dashboards: In a world where data is king, real-time insights are priceless. With the implementation of this project, banks will be equipped with powerful, real-time dashboards that provide deep insights into their loan portfolios.

- Full Control over Risk Acceptance and Costs: Banks will have full control over risk acceptance and cost levels, ensuring their lending practices align with their strategic objectives and financial stability.

This ambitious endeavor seeks to not only spur growth within banks but also drive digitization in various processes. At its core, the project's objective is to provide banks with a golden opportunity to tap into the salary working loan market of government employees while maintaining full control over risk acceptance and cost management. The driving force behind this endeavor is digitizing the entire process, which promises to reduce operational costs significantly.

However, this venture is not without its challenges. Here, we'll delve into the key components of this exciting project and explore the innovative solutions Simbuka aims to implement.

The numbers speak volumes

- Return on investiment (ROI): the return on investment is exceptional, with an ROI of over 750%. This means your investment can be recouped within just 3-6 months!

- Implementation time: the implementation period is around 3 months, depending on local systems.

- Market potential: the market is vast, encompassing over 700,000 governmental employees with an average salary of about 1 million Tzs. Expect a monthly influx of between USD 500 million and USD 1 billion in new loans.

The challenges

- Manual application process: one of the major stumbling blocks in the path to efficient lending has been the manual application process. Traditional, paper-based methods have long hindered the pace at which banks can process loan applications. The need for a faster and more streamlined approach is evident.

- Limited experience with governmental employees: Tanzanian banks have relatively limited experience when it comes to governmental employees. This lack of historical data poses a unique challenge in assessing the creditworthiness and repayment capability of this particular demographic. Without a clear understanding of the borrowers' financial behavior, it becomes difficult to make informed lending decisions.

- Limited data for risk assessment: accurate risk assessment is the cornerstone of responsible lending. Unfortunately, in this context, limited access to data complicates the banks' ability to gauge the potential risks associated with loans to government employees. Developing a comprehensive risk assessment strategy becomes essential.

The solution

Simbuka is actively working on implementing a multifaceted solution that addresses these challenges head-on. The key features of this solution include:

- Fast turn-around time: recognizing the need for expediency in the lending process, the project aims to develop a system that drastically reduces the time it takes to process loan applications. Through automation and digitization, applicants can apply 24 /7. The applicant will get the loan in a few seconds as the process is fully automated.

- Low operational costs: the heart of the project lies in its commitment to slashing operational costs. By transitioning to a digital framework, banks can significantly reduce overhead expenses associated with manual paperwork, document verification, and data entry. The result? A more cost-effective lending system that benefits both banks and borrowers.

- Risk-averse: Simbuka's solution places a strong emphasis on responsible lending practices. By leveraging data analytics and advanced algorithms, banks can make informed decisions regarding risk acceptance. This not only protects the financial stability of the banks but also ensures that borrowers are not burdened with loans they cannot manage.

In conclusion, Simbuka's integration with the government of Tanzania marks an exciting milestone in the country's banking sector. This project is set to reshape the lending landscape by fostering digitization, reducing operational costs, and promoting responsible lending practices. While challenges certainly lie ahead, the innovative solutions being implemented promise a brighter, more prosperous future for both banks and the employees they serve. Visit simbuka.com today for exclusive updates, news, and opportunities to get involved, and stay tuned for further updates on this groundbreaking initiative that aims to empower Tanzanian banks and promote financial inclusion.

Try and experience the impact yourself

The Next-Generation Loan Management Platform streamlining loan processes like never before. Dive in and see the difference firsthand!