Unlocking the Power of Scorecards: A New Era in Credit Scoring

In the ever-evolving landscape of the banking and finance industry, staying ahead of the curve is not just a goal; it's a necessity. One of the most critical tools at the disposal of financial institutions is the scorecard. But what exactly is a scorecard, and why is it essential in credit scoring? In this blog, we'll delve into the world of scorecards, explore why traditional methods of creating them are no longer viable, and introduce you to a powerful solution that can revolutionize your credit scoring process.

The Scorecard Unveiled

Let's start with the basics: What is a scorecard? In finance, a scorecard is like a compass guiding loan officers and financial institutions through the intricate terrain of credit assessment. It's a robust tool used to evaluate loan applications, helping to distinguish between the borrowers who are likely to be a good fit for a loan and those who may pose a higher risk.

The Critical Role of Scorecards in Credit Scoring

Now, why are scorecards so vital in credit scoring? The answer lies in their ability to bring objectivity and consistency to decision-making. By analyzing various factors and historical data, scorecards provide a standardized method for assessing creditworthiness. This streamlines the lending process, helps mitigate risks, and reduces the chances of bad loans.

Traditionally, financial institutions have created one-off scorecards to meet their specific needs. While this approach worked for a time, it's become increasingly impractical and costly. Manual labor from developers, time-consuming updates, and the expense associated with each modification have become significant roadblocks. In a fast-paced industry, relying on outdated methods can result in lost opportunities and increased operational costs.

The Game-Changer: Scorecard Engine by Simbuka

Imagine a system that empowers you to create scorecards and update and maintain them effortlessly over time — no more expensive development work or manual updates. Our powerful solution is designed to meet even the most complex requirements of modern credit scoring.

With Scorecard Engine, you can aggregate data from various external sources or use user input to craft scorecards that align perfectly with your institution's needs. In complex scenarios, we offer scorecard chaining, allowing you to navigate intricate decision-making processes seamlessly.

But that's not all. We understand that financial institutions have unique systems and data sources. That's why Scorecard Engine is designed for full integration with any system, allowing you to harness the power of your existing infrastructure for automated credit scoring. Moreover, our extensive API opens doors to building other complex solutions tailored to your institution's requirements.

Creating scorecards is just the beginning. Scorecard Engine enables you to monitor their effectiveness right within the system. With various charts and export options, you can stay on top of your credit scoring game, ensuring your institution remains competitive and resilient.

Building a Scorecard

You might wonder how easy it is to build a scorecard?… and we have your answer. It’s as simple and manageable as it can get. That’s why we have created a step-by-step guide for you:

- Creating Arguments. The first step in crafting a scorecard is defining the criteria that matter most to your evaluation. These criteria, known as "arguments," can take be of various data types.

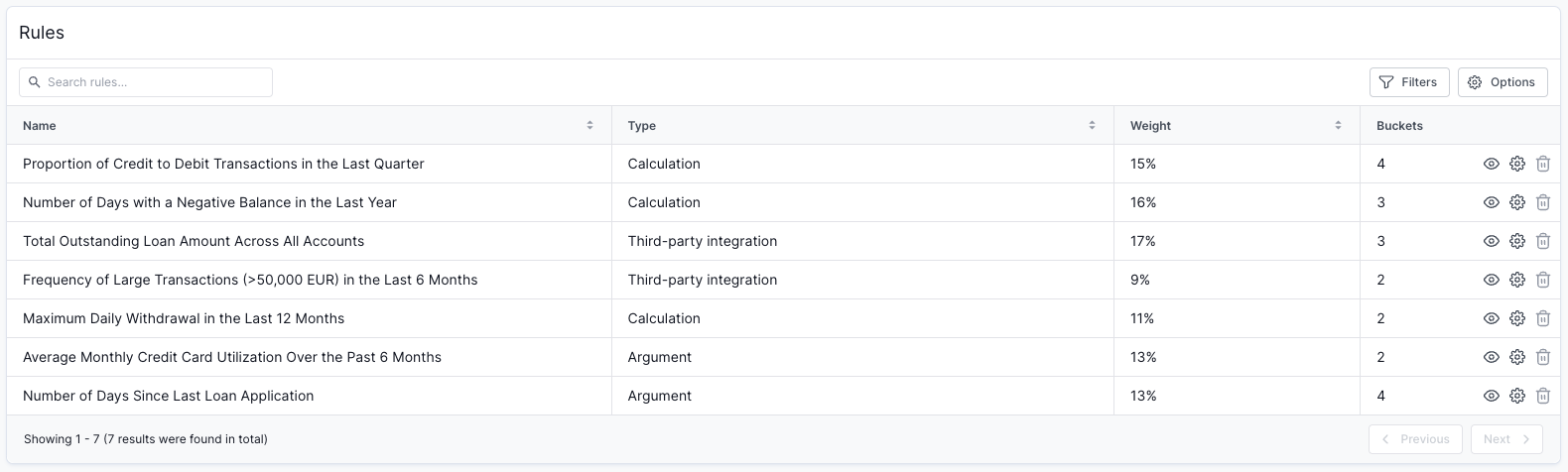

- Establishing credit scoring rules. Once your arguments are created, it's time to set the rules that govern them. Here's where the Scorecard Engine truly shines. You can relate rules to the arguments you created, reference different scorecards, fetch data from any third-party source, or even perform complex calculations akin to Excel. This exceptional flexibility ensures that your scorecard reflects your unique evaluation criteria accurately. All rules evaluate towards a score that makes up your final credit score.

- Assigning labels to scores. In addition to creating powerful evaluation criteria, the Scorecard Engine simplifies the interpretation of results. The classifications lets you assign meaningful labels to scorecard outcomes, such as "low," "medium," "high," or even "approved" and "disapproved." This not only enhances clarity but also streamlines decision-making processes.

Ensuring Accuracy and Consistency

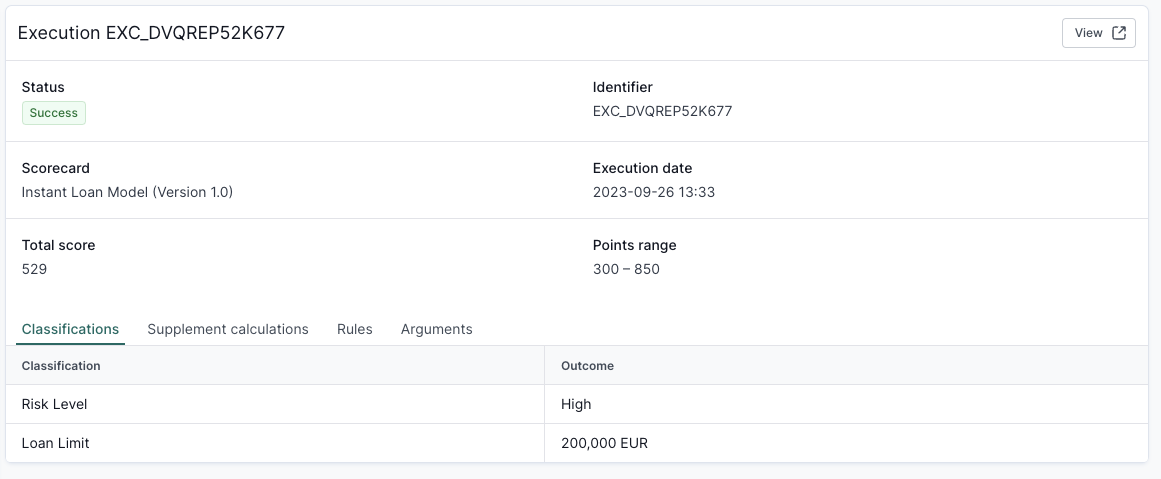

Before putting your scorecard into action, the Scorecard Engine empowers you to test it thoroughly. When the credit score is generated, you can analyze the results per rule, making identifying anomalies or inconsistencies easy. This transparency ensures that each argument contributes to the overall evaluation as intended.

Powerful Lookup Tables: Your Data Hub

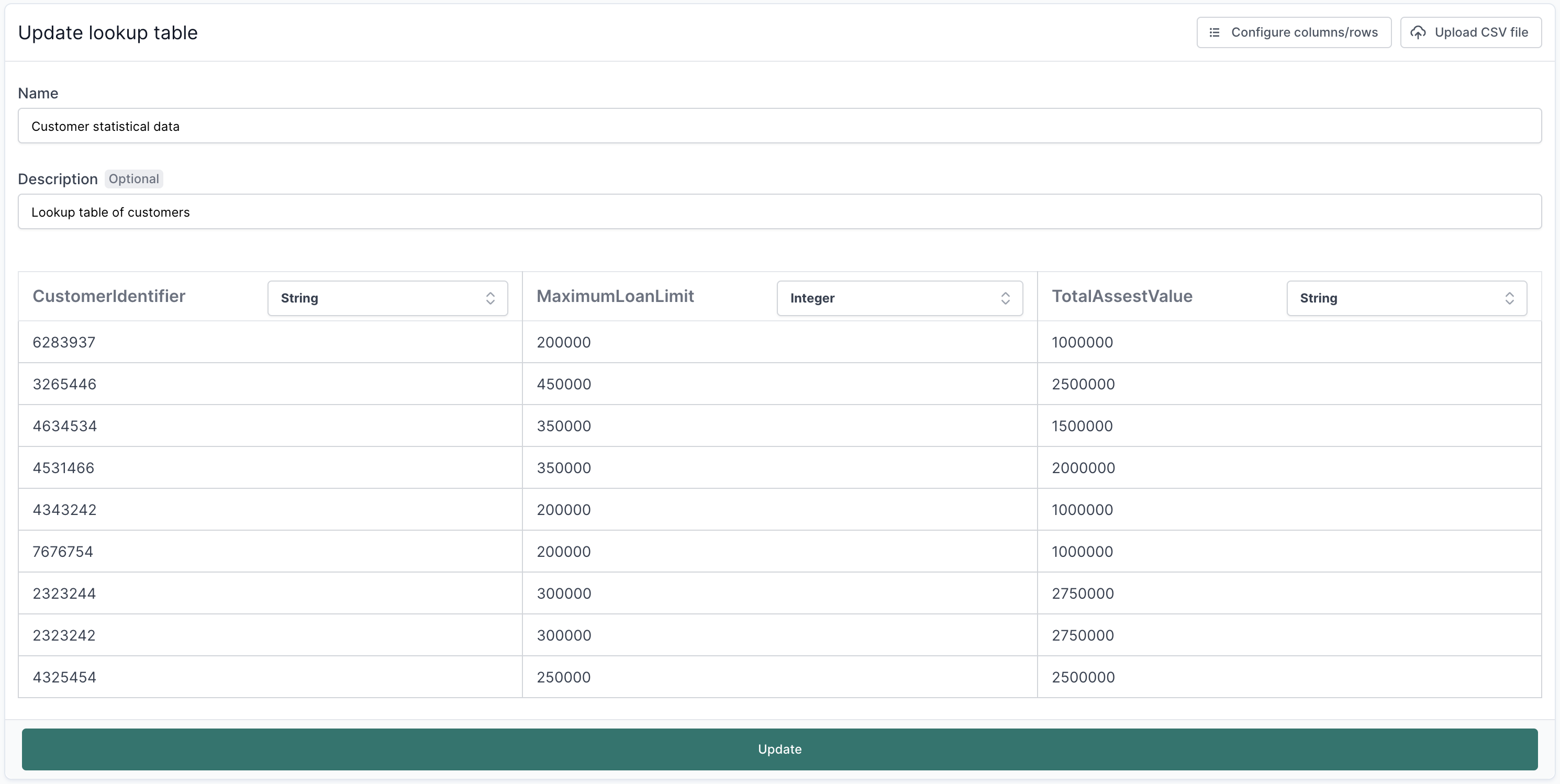

The Scorecard Engine takes data management to the next level with its lookup tables feature. You can create Excel-like tables directly within the system, manually input data or upload CSV files, and even keep them updated through API connections. These tables act as a database or tracker, providing quick access to essential information for your credit scorings.

From Creation to Execution: A Seamless Journey

In summary, the Scorecard Engine simplifies the journey of creating, testing, and monitoring scorecards. After rigorous testing, you can publish your scorecard, enabling you to execute evaluations and utilize it within your organization's systems. The results are available via the API, CSV exports, or in PDF format, making them easy access, share, and analyze.

Best of all, you can create multiple versions of the same scorecard without deleting previous iterations. This means you can continuously refine and adapt your evaluation criteria as your needs evolve. The Scorecard Engine is your gateway to informed decision-making. Its intuitive interface, powerful features, and seamless integration capabilities revolutionize how you evaluate and analyze data. Say goodbye to manual, error-prone evaluations and embrace a more efficient, precise, and dynamic approach with the Scorecard Engine. Your journey to data-driven excellence begins here.

Try and experience the impact yourself

The Next-Generation Loan Management Platform streamlining loan processes like never before. Dive in and see the difference firsthand!