From Micro Giving to Micro Credit: Simbuka's Role in Creating 1100+ Jobs in Uganda

In the heart of the Mpigi region, a district in Central Uganda, an exciting project takes place, set to change the lives of young women. The "From Micro Giving to Micro Credit" project is on a mission to empower, support, and create opportunities for these women, all made possible through funding from the Challenge Fund for Youth Employment, administered by the Foreign Affairs Ministry of the Dutch Government.

Since its launch in August 2022, Simbuka, in collaboration with 100WEEKS, Rabo Foundation, and AMFIU, has been actively driving this project. The early results are truly remarkable, showcasing the substantial impact it's having on the lives of young individuals.

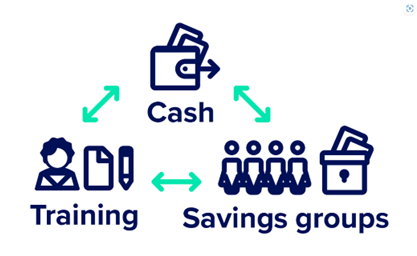

The main goal of this ambitious project is to uplift 600 young women under the age of 35 facing economic challenges. The project aims to empower them through a combination of unconditional cash transfers, a 100-week training program, the facilitation of VSLA (Village Savings and Loan Association) saving groups (micro-giving), and access to finance (micro-credit). Our objective is to help them become self-reliant and successful businesswomen.

The "From Micro Giving to Micro Credit" project Explained

The "From Micro Giving to Micro Credit" project is a multi-faceted endeavor, comprised of two main components:

- From Micro-Giving… One of the core elements of our project is the Micro-Giving component. Implemented by 100WEEKS, this initiative aims to provide temporary weekly cash support, training, and the facilitation of VSLA (Village Savings and Loan Association) saving groups. This support, amounting to EUR 8 per week, will reach a total of 600 young women in the region. The impact of this Micro-Giving component is profound. Not only does it help these women overcome scarcity, but it also equips them to invest in a brighter future, increase their human capital, and ultimately escape the clutches of poverty. Research conducted by 100WEEKS indicates that an astounding 80% of program participants will lift themselves out of poverty during the program. What's even more remarkable is that 71% of these women will remain out of poverty even one year after the program concludes.

- ...to Micro-Credit The second crucial component of our project revolves around Micro-Credit, facilitated by a financial institution empowered by Simbuka. Women who successfully complete the Micro-Giving phase will have the opportunity to expand their businesses with financial support. Rabo Foundation will play a pivotal role in designing and establishing the credit scoring parameters and model, ensuring that these women have access to the financial resources they need to thrive. In a nutshell, with the money, these women can make their businesses even bigger.

How does it work in practice?

Participants in this program are organized into groups of 20 to 25 women. Over 100 weeks, these groups receive crucial support in the form of mobile cash donations and comprehensive training. This money is not a loan and does not require repayment. The program's holistic approach includes financial literacy, entrepreneurial skills, life skills, and best agricultural practices. These weekly sessions are led by dedicated coaches who guide participants towards economic independence. Participants also become part of savings groups that offer support to those who have demonstrated their ability to chart a sustainable future for their families.

Ultimately, our goal is to help participants escape poverty in 4 steps:

- Overcome scarcity: Individuals enduring severe poverty frequently find themselves trapped in a constant struggle for survival, where securing their next meal becomes their sole preoccupation. Once their fundamental needs are satisfied, they can shift their attention towards the future.

- Invest in a brighter future: With their daily survival no longer in jeopardy, participants in the 100WEEKS program redirect their attention. The majority opt to invest in launching a new small business, expanding an existing one, or acquiring land and livestock.

- Enhancing Human Potential: Program beneficiaries receive training in financial literacy, entrepreneurship, and essential life skills within peer groups. Through collective support, their social capital is bolstered.

- Breaking Free from Poverty: Throughout the two-year program, participants cultivate sustainable livelihoods. By the end of the 100 weeks, the majority have successfully transitioned out of poverty on a sustainable basis.

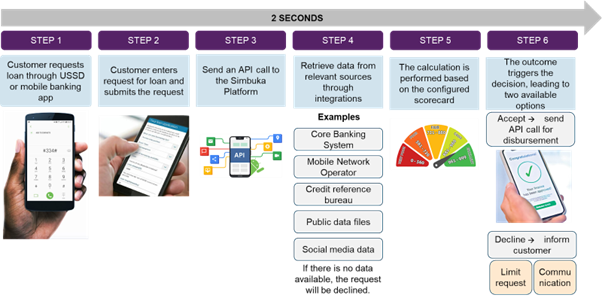

Simbuka's Journey to Inclusive Banking

In the bigger picture of the Micro-Giving to Micro-Credit Project, Simbuka's goal is to make it easier for people to get loans. Banks and other money institutions have been hesitant to give loans to people in rural areas, especially if they don't have a bank account. This happens for many reasons. On one side, people in rural areas don't have a history of borrowing money, they don't often use banks, they might not know much about how to use digital and money stuff, and they have to pay high interest on loans. On the other side, the financial institutions can't reach the far-away rural areas with digital tools, they take a long time to decide if they should give a loan, and many banks think people in rural areas are risky customers.

Simbuka wants to change all of this. Simbuka’s software solutions empower financial institutions to make lending money faster and better. Both the banks and the customers, especially young women, will benefit from this. Loans will be quicker, cost less, and be decided fairly.

1,128 Jobs and Much More: The Impact of Micro Giving to Micro Credit

The "From Micro Giving to Micro Credit" project is not just about creating jobs, although it will result in the creation of 1,128 much-needed employment opportunities. It's about opening doors, breaking down barriers, and giving young women in the Mpigi region the chance to take control of their destinies.

As we continue with the project, we believe that the consortium can create a meaningful and long-lasting improvement in the lives of many. If you want to learn more about this project, visit this link.

Be sure to keep an eye out for our next blog, where we'll reveal the remarkable results achieved in the first year of this program. Stay tuned!

Try and experience the impact yourself

The Next-Generation Loan Management Platform streamlining loan processes like never before. Dive in and see the difference firsthand!